If you're a loyal reader of this blog who happens to work at a financial institution, odds are you're familiar with the concepts of inbound marketing. At the same time, you maybe realize that your firm has been relatively slow at transitioning towards an inbound marketing-centric world.

It's not particularly difficult to see why firms are reluctant to revamp their marketing strategy; change can be difficult, especially when it involves reexamining ideas that have been engrained in your team for years.

Fortunately, we come to you bearing good news. First, transitioning towards an inbound marketing strategy doesn't need to be painful or disruptive. And two, we will now show you how to do it.

Understanding Financial Institution Inbound Marketing

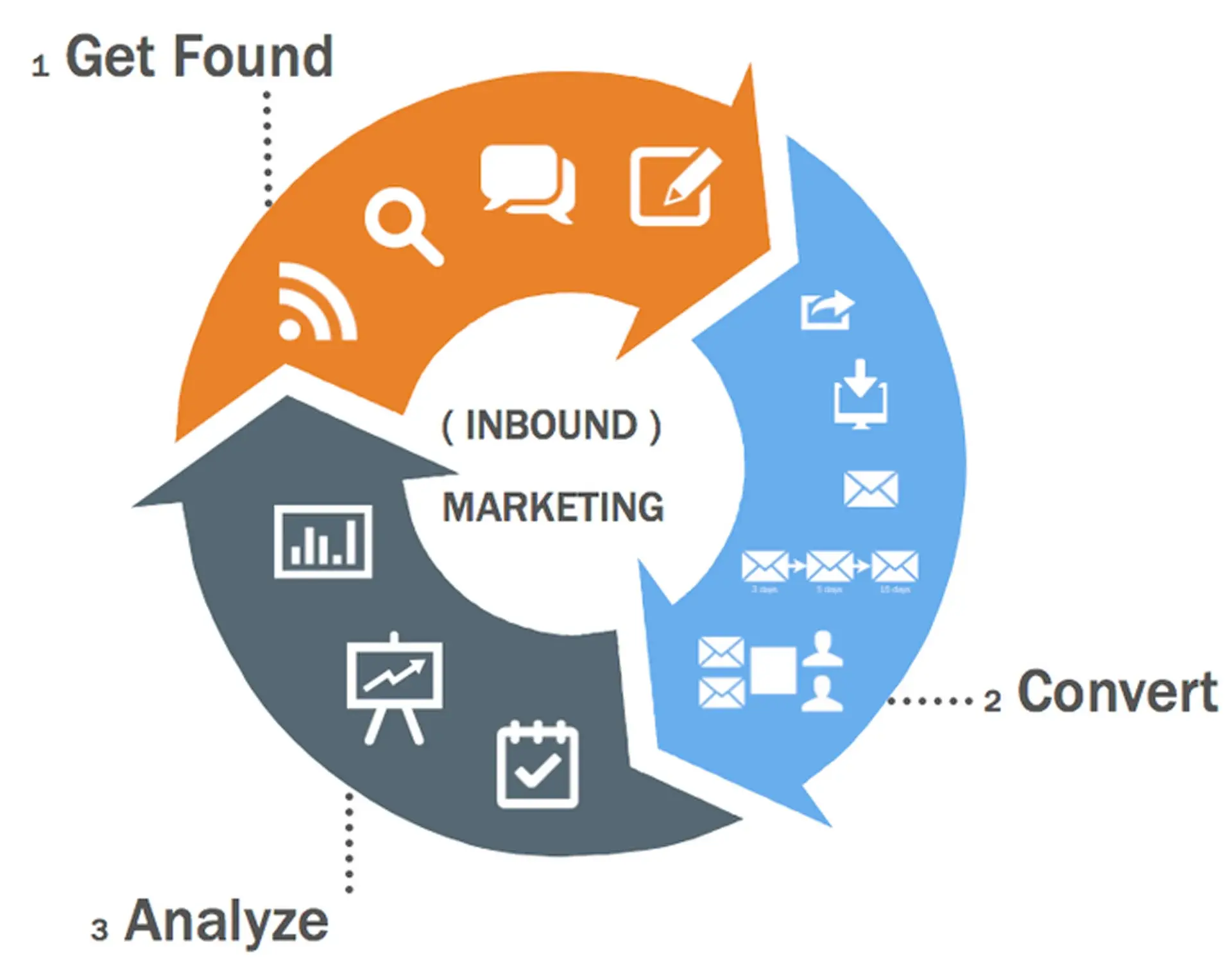

Inbound marketing won't completely eliminate "outbound marketing" techniques, but instead complement them. Inbound marketing will simply help your team respond to the ever-changing shifts in technology and customer behavior that characterize our increasingly mobile- and social media-driven world. After all, customers nowadays are a savvy bunch. They research services and products on sites ranging from Yelp to Amazon to Facebook to Google Search. As a result, it isn't enough for a financial services firm to sit back and hope for the best. Instead, they need to promote their brand through a robust social media presence built on compelling content. By doing so, consumers will most likely find you before you find them.

Putting the Pieces in Place

The need to create powerful content and exude expertise is doubly important for the financial services sector since these firms need to establish trust and piece of mind with prospects and customers. Therefore, marketing managers at financial services firms need to understand the tools at their disposal to make these inbound marketing principles come to life. They include things like:

-

Create unique content that speaks to buyer personas and their needs.

-

Publish three-to-five 500-750 word blog posts a week.

-

Write eBlasts, eBooks, and White Papers that speak to your expertise and act as deliverables tied to landing pages.

-

Understand of where your prospects are in terms of social media platforms.

-

A coherent and integrated social media marketing strategy.

-

Create videos to engage prospects, particularly those at the bottom of the sales funnel.

Inventorize, Prioritize, Outsource, and Execute

Now that you understand the key components of an inbound marketing strategy, ask yourself these questions:

-

"Which of these activities is most critical to our success?"

-

"Do we currently execute any of these activities in-house? And so, do we execute them efficiently and effectively?"

-

"If not, what's the cost-benefit analysis or outsourcing certain inbound marketing activities?"

-

"How will these activities interface with our existing outbound marketing activities?" For example, you may still have a marketing assistant conducting lead generation by calling firms in a local business directory. Inbound marketing lead generation — conducted via LinkedIn, for example — may complement or entirely replace this older activity.

Now we'd like your feedback. Has your firm begun the transition towards financial institution inbound marketing? What elements of inbound marketing have proved particularly useful to your business? What do you look for in a third-party inbound marketing agency?

Thinking an inbound marketing agency can help guide this transition? Download our How to Hire and Inbound Marketing Agency eBook for more information.